Environmental, social, and governance (ESG) considerations are becoming more important in investment decision-making.

Considering Environmental, Social and Governance factors in the underlying Scheme investments means ensuring the companies in which we invest are responsible stewards of the environment, good corporate citizens, and are led by accountable managers.

Pension schemes need to analyse their sustainability practices. As part of this, there is a requirement for pension schemes to disclose climate-related risks and opportunities, through a standardised approach, known as the Task Force on Climate-related Financial Disclosures (TCFD) framework.

In this article, we summarise the latest TCFD report for the Horizon Pension Scheme, including the actions taken by the Trustee and how we assess progress.

- The report has been prepared in accordance with the Occupational Pension Schemes (Climate Change Governance and Reporting) Regulations 2021, which came into force on 1 October 2021 and are based on the recommendations of the TCFD.

- The purpose of the regulation is to promote better climate-related disclosures and more effective management of climate risks and opportunities.

- It also incorporates the recommendations published by The Pensions Regulator (TPR) following its review of TCFD reports published in April 2024.

- The TCFD recommendations provide a framework organised around four pillars: Governance, Strategy, Risk Management, and Metrics & Targets. This report has been structured to provide disclosures across each of these pillars under the main headings Governance; Strategy, Identification and Assessment of Climate Related Risks and Opportunities; Management of Climate Related Risk; and Metrics and Targets.

Over the last 12 months, the Trustee has enhanced its governance arrangements covering the identification, assessment and management of climate related risk and opportunities. To this end, the Scheme has developed a robust strategy to deliver key net zero ambitions.

The key tools used by the Trustees are:

Using our investor influence, we encourage the heavy polluters to change through engagement on climate considerations, amongst other things.

Engagement covers both voting on management proposals where the Scheme has an ownership stake and also broader conversation on different themes. The Scheme’s Implementation Statement provides an overview of our engagement.

We undertake climate scenario analysis based on three industry recognised climate scenarios - namely Net Zero 2050, Delayed Transition and Hot House World.

The analysis demonstrates that the Scheme’s position in all three scenarios across all three-time horizons is resilient.

The Trustee monitors the four chosen metrics on an ongoing basis and since the base year of 2022, positive progress has been achieved with the reduction in carbon emissions. Our thesis for continuing to use these metrics is unchanged from last year and in line with our competitor analysis and The Department for Work and Pensions (DWP) guidance:

Weighted Average Carbon Intensity (WACI)

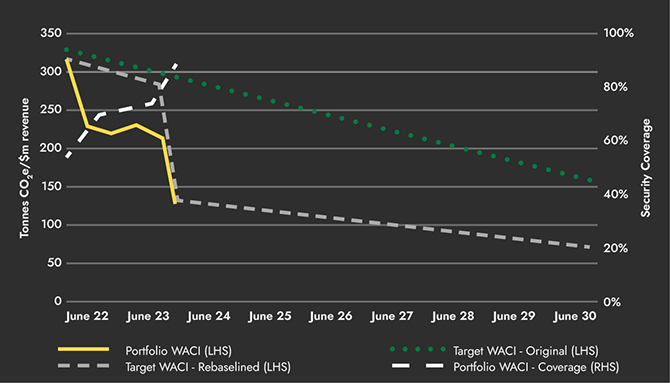

WACI fell by 61% from the baseline in September 2022 over the period to December 2023, reflecting significant positive progress driven by strategic changes to the portfolio. As a result, the Trustee has agreed to re-baseline the WACI target as of 31 December 2023. The WACI remains well on track to achieve the Trustee’s revised target by 2030. The chart below illustrates the ongoing positive trajectory.

Financial emissions

Absolute financed emissions increased by 62% since June 2022. Unlike relative emissions (such as intensity metrics like WACI), which are adjusted for financial or operational factors, absolute emissions measure the total emissions without any adjustments. Although the increase appears significant, it largely results from improved coverage of underlying companies by data providers and increased transparency following changes to the investments held. The DWP specifically recommends using absolute metrics, making this important for regulatory adherence. Consequently, while the rise indicates greater visibility of our emissions profile, it does not necessarily reflect poorer environmental performance.

Implied temperature

Total portfolio implied temperature rise decreased from 3.37°C to 3.17°C, showing improved alignment with global temperature goals. These figures may fluctuate due to evolving data, methodologies and company targets. The relatively high scores partly reflect methodological limits and uncertainties in projecting long-term climate outcomes. By monitoring and improving this metric, the Scheme reaffirms its commitment to aligning investments with global climate goals and supporting the transition to a low-carbon economy.

Data quality

Carbon data quality improved substantially, increasing from 50.37% in September 2022 to 75.18% as of December 2023. This significant improvement in total and reported carbon data coverage suggests improved reliability, completeness, and decision-usefulness of the climate metrics, facilitating more accurate tracking of risks and opportunities.

The Trustee believes that the Horizon Pension Scheme has an important role to play in contributing to the global management of climate related risk, and as such takes its role in this very seriously. However, the Trustee also acknowledges the data limitations and the resulting impact on the analysis undertaken thus far. The Trustee commits to continuing to work in collaboration with its advisors to improve the quality of our climate assessment over time.

There are methodological deviations between WACI & financed emissions meaning they don’t change at the same rate; notably, the financed emission is an absolute measure, and metric is not adjusted for portfolio sizing. The financed emission can be more directly linked to a carbon budget and real-world emissions

Read full climate report here.